Smart Finance Management: 10 Money-Saving Tips

Managing your personal finances is a critical aspect of life. Although you might not be able to influence the economy, the decisions you make are within your control.

Definition of Finance Management

Budgeting and finance management is about planning, organizing, and controlling financial activities such as buying new things, paying for electricity, and so on. This means applying the principles of the basics of finance management.

Besides saving your money, you can use a $500 loan. It is a type of personal term loan issued by a bank. In such loans, you will have to return the money in parts, and not immediately. Previously, only banks issued such loans, but now you can apply for such loans online.

Challenge yourself and start taking control of your finances. Set a goal for yourself in 2024 to deal with your budget.

How to Start Saving Money?

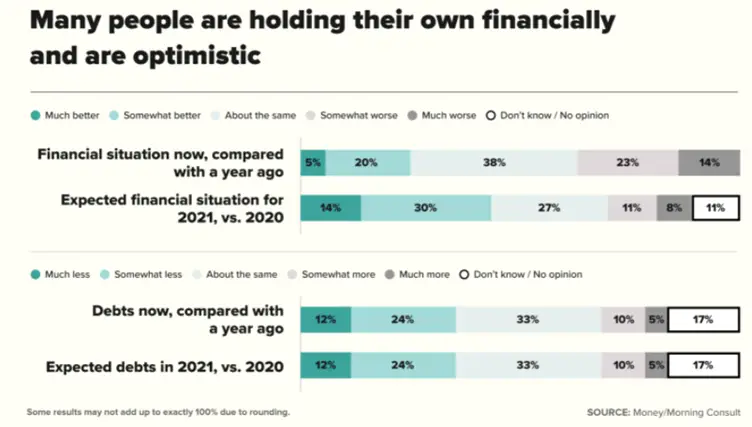

According to a survey, 9 in 10 adults say nothing makes them happier or more confident than having their finances in order. This guide is your ticket to joining in.

It is important to know that and finance process management is a science that studies methods for the efficient use of capital, ways to get the most profit with the least risk, and a rapid increase in capital.

Don’t know how to start saving money? We have 10 saving money tips:

#1 Make a Budget

At the heart of any savings plan is a budget. Making a plan will help you control your expenses and avoid rash purchases.

Checking your credit card statements, bank balances and receipts will help you calculate your expenses.

Monitoring your credit card is also helpful in understanding what you are spending the most money on. This can be food delivery, payment of public servants, transport, and so on.

#2 Know Your Money Priorities

Before budgeting, you need to determine your priorities. If you skip this crucial step, you won’t buy into your financial plan. You need a focus to align your money goals with your money habits. That focus is what’s most important in your life, right now.

Do you have credit card debt that makes your stomach churn just thinking about it? Paying that down might be your No.1 priority.

Patrice Washington, a leading authority in personal finance, entrepreneurship, and more, advises that money priorities align with your personal values.

“The largest categories should reflect what matters most to you,” whether you value international travel or taking care of your body. Then you can cut back on other categories to “save at maximum capacity” for your true priorities.

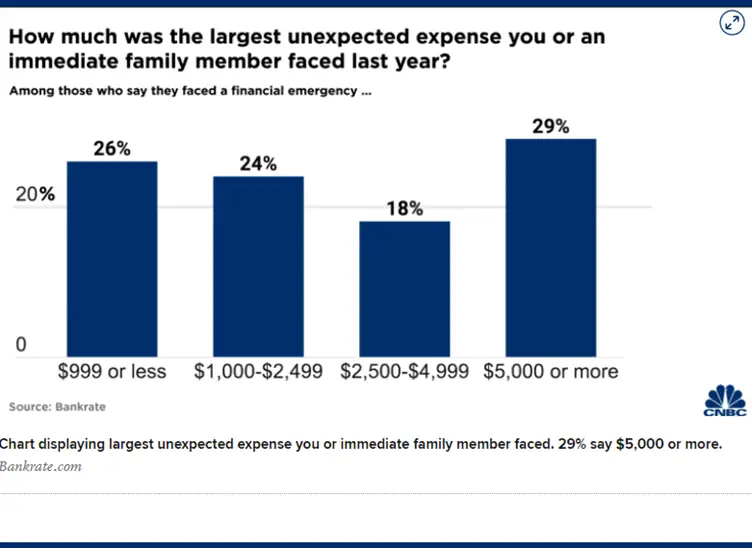

Maybe it’s a wedding or a vacation you want to save for. Or, perhaps you want to establish an emergency fund so you’re not “up a creek without a paddle” when your car needs an engine overhaul or your pet needs surgery.

Whatever concerns you most, make that your priority, at least to start.

#3 Track Where You Spend Your Money

You can use the best finance management app to understand better where you spend money the most. You will be surprised how much money you spend on a car or on eating out.

#4 Separate Wants From Needs

Do you really need that iPhone 13 or that 40-inch flat-screen television? When money is tight it should not be spent unless absolutely necessary. Make a shopping list every time you go to the store.

#5 Plan Your Purchases

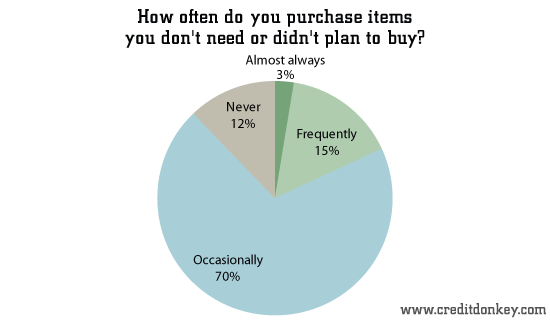

If you know that within a week you need to go to the store 2 times, there’ll be no need for random visits to the supermarket. This will lead to unnecessary rash purchases.

Make a list of the essentials before going to the store. This will protect you from unnecessary purchases. You should not chase discounts for buying products you do not need. This is not a budget-cut way.

#6 Open a Savings Account

The Savings Account service allows you to receive additional income for the number of funds accumulated on it, which the Client independently regulates.

“Round your bank account down every time you check it and transfer the amount to your debt or savings,” says Kylie Travers-the CEO of Occasio Enterprises.

She owns and operates several personal finance websites.

#7 Focus On Recurring Expenses

Look at the list of your purchases for the last month and you will understand what you are spending the most on. We talked about this in the previous paragraphs. You will be shocked.

Spend the day going over it all and you can save a million dollars. It may seem like a couple of dollars is not much, but you can save thousands of dollars with repeat purchases.

Even if you’re happy with your mobile and internet service providers, find out if they have a cheaper rate. Walk to the store instead of home delivery.

#8 Control Your Impulses

Online shopping, credit cards make spending money easier. We’re not talking about the really important things you want to get, it’s about spontaneous purchases. The degree of temptation usually yields to our willpower. Research has shown that self-control is a bit like a muscle that gets tired of using it.

“Rather, for people living in poverty, every decision – even whether to buy soap – requires self-control and sinks into their limited supply of willpower.”

Wait at least a day before making a major purchase. You may notice that the chewing is going away. Another excuse for considering a purchase is to compare how many hours of work correspond to the purchase price. Most likely you will refuse to purchase.

#9 Avoid a Poverty Mentality

Many people think that thrift is a way to save money, and the thoughtless use of money and other resources is charity.

We need to eliminate excessive frugality, it will not give you the opportunity to achieve financial success, but, on the contrary, will drive you into poverty. Everything should be in moderation.

Excessive frugality leads to constant stress. These people stomach in fear of loss and failure, while frugal people thrive and base their decisions on possible gains.

#10 Watch Your Savings Grow

Check your balance every month and track your progress. Such a way will help you stick to your personal plan and fix problems quickly. Understanding how easy it is to save money will inspire you to achieve your goals faster.

As a result, one of the best ways to manage your money and hopefully hold on to more of it — is to follow a budget.

These 10 tips on how to save money fast can help you reach your savings targets without breaking a sweat. As we mentioned earlier, it can be helpful to have a specific goal in mind when you’re setting up a plan to save money fast. We wish you the best in your financial endeavors!